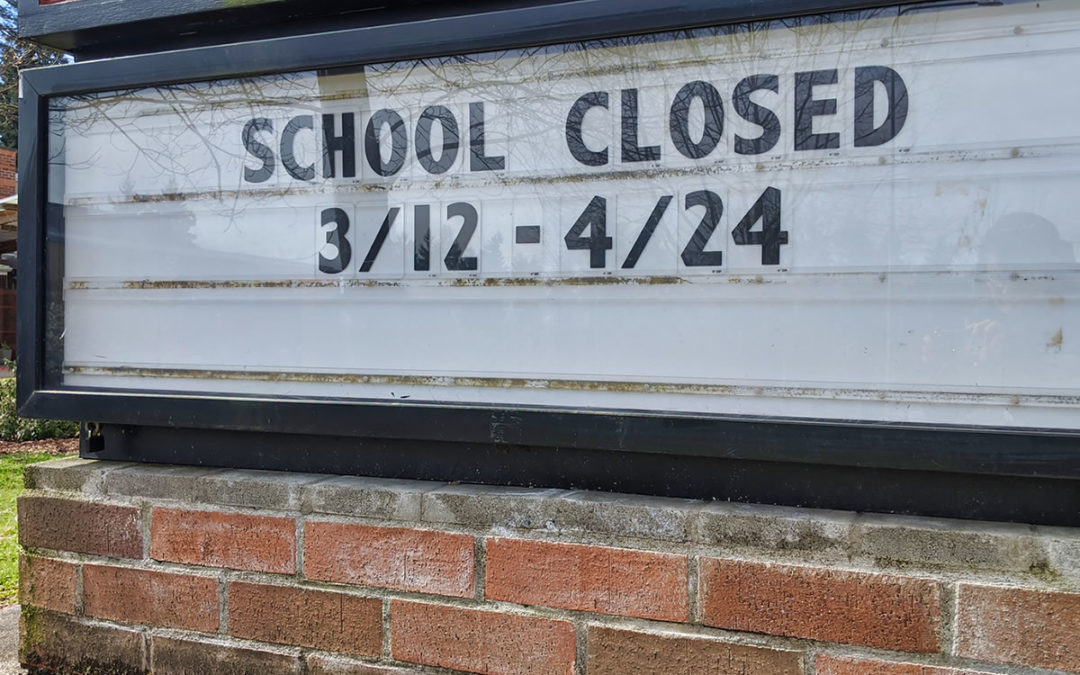

According to a poll conducted in April of this year, 64% of Americans support school choice, meaning the tax dollars designated for a child’s education should follow that child to a school of the family’s choice. And, in this unprecedented time, an interest in permanent homeschooling has soared, with 40% of families are more likely to homeschool their children or enroll them in virtual school after the end of the lockdown. Just this past week, USA Today released a poll showing 59% of families are more likely to homeschool.

These numbers prove that families want to control how and where their children are educated. But the American education system, as it exists today, limits such opportunity. This is particularly true for families with moderate to lower incomes, who cannot afford tuition to access private schools and cannot afford to stay home to educate children during the day.

As economic uncertainty continues, more families may lose access to alternative educational options. Unlike public schools, private schools lack a guaranteed source of funding. Families are struggling to pay tuition, fundraisers have been canceled, and Sunday collections ceased. If these schools close, the consequences will be dire not only for the children they serve, but for Iowa taxpayers as well.

Iowa spends more than $12,000 per student in public school each year. Some estimate as many as 20% of private schools nationwide will close permanently as a result of COVID-19. If just 10% of the children attending a private school in Iowa return to the public system, it would cost the state more than $86 million. If 20% close, it will cost taxpayers $172 million.

One way to preserve educational options and opportunity in Iowa is by growing the state’s successful tax credit scholarship program, which currently serves more than 10,000 children and, according to the Iowa Department of Revenue, saves taxpayers more than $12 million per year. Many participating families have moderate to lower incomes. Take, for instance, the Hansen family. Mrs. Hansen is a public school teacher and mom whose children are thriving in a private school made possible by the program.

Advocates for educational options are seeking to help more families like the Hansens.

“We are planning on a full push this legislative session to help lower and middle-income families have as many educational options as possible,” says Trish Wilger of the Iowa Alliance for Choice in Education. “The STO program has been so successful and we want to continue its expansion; families impacted by the economic downturn are asking for help in affording nonpublic education. As we’ve learned from this pandemic, families need to have more flexibility when it comes to their child’s K-12 education.”

Policymakers must work to ensure no child is deprived of a school where she or he is thriving due to an unforeseen national health crisis. They should empower families, regardless of income, to choose the school setting that works best for them, whether public, private, virtual or at home. And they must seize opportunities to enact smart economic policies in a time of uncertainty and instability. Growing the successful tax credit scholarship program and enacting additional school choice policies would do just that.